The automation system integration business accounts for nearly $20 billion worldwide in engineering services and related product revenues, according to the Control System Integrators Association (CSIA). Exactly what that figure represents depends in large part on the definition of "system integrator.

AT A GLANCE

Industries and areas served

Engineering specialties

Product experience

Corporate and professional affiliations

Age and annual revenue

Sidebars: Simplify the search for a system integrator

The automation system integration business accounts for nearly $20 billion worldwide in engineering services and related product revenues, according to the Control System Integrators Association (CSIA). Exactly what that figure represents depends in large part on the definition of “system integrator.” Control Engineering collects demographic information for the Automation Integrator Guide (also online at: www.controleng.com/integrators ) and analyzed results for this article.To the CSIA, a system integrator is “an independent value-added engineering organization (or profit-loss division) that focuses on industrial control and information systems, manufacturing execution systems, and plant automation that require application knowledge and technical expertise for sales, design, implementation, installation, commissioning, and support.”

For the purposes of Control Engineering’s annual Automation Integrator Guide ( Control Engineering , December 2005), a system integrator is any contract-engineering firm that can supply the time , talent , and technology required to integrate the disparate components of an industrial automation system with a facility’s production equipment. That would include CSIA integrators as well as companies capable of providing integration services on the side such as vendors, distributors, and architecture & engineering (A&E) firms with their own system integration divisions.

CSIA estimates that, worldwide, some 2,200 integrators fit its definition, but the total number that match the broader definition has proven more difficult to ascertain. System integrators are generally not high-profile businesses. Most serve specific industries in limited areas, relying primarily on personal contact to promote their services. Finding them is not easy. (See the sidebar “Simplifying the search.”)

What’s in a name?

Nomenclature is also an issue. Vendors, distributors, and A&E firms are generally reluctant to describe themselves as “system integrators,” and many companies that do use that title often employ variations adding: control, computer, information, manufacturing, or robotic to the term “system integrator.”

It’s much easier to characterize system integrators by what they do rather than what they call themselves. System integrators surveyed for the 2006 Automation Integrator Guide have a great deal in common. Although under half described the work as automation-and-control engineering, some 61% cited programmable logic controllers (PLCs) as an engineering specialty. (See the “Engineering specialties” chart.) Tied for second place among the most popular engineering specialties were human/machine interfaces (HMI) and instrumentation and data acquisition systems. Process control rounded out the top five.

Ironically, some of the control functions most commonly associated with PLCs—motion control, automated assembly, machine controls, and other discrete control applications—ranked 7th, 18th, 22nd, and 24th, respectively. One of the most common computing platforms for process control—distributed control systems—ranked 14th. PC-based control fared no better than 81st.

These results reflect the continuing growth of the PLC market, especially in the process industries where PLCs are being equipped with continuous control capabilities. PLC-based automation projects are particularly popular with system integrators, since PLCs are available off-the-shelf with a wide variety of standard features. As a control-computing platform, PCs have yet to gain such widespread acceptance among system integrators. System integrators still tend to relegate PCs to data acquisition and HMI chores.

Engineering specialties

Although regarded by some as a commodity product with mature technology, the PLC remains the computing platform of choice among system integrators.

Survey results also reflect these engineering specialties in the brand names that the respondents cited most under product experience. (See the “Product experience” chart.) Four of the top five spots were accorded to PLC vendors Allen-Bradley (Rockwell Automation), Siemens Energy and Automation, Schneider Electric, and GE Fanuc Automation. All four of these vendors, plus the second place finisher Wonderware (Invensys), also offer software for controller programming and/or HMI. Furthermore, eight of the 10 most-popular vendors offer instrumentation and data acquisition products, such as field measurement devices, input/output modules, and networking equipment.

Although Allen-Bradley was the brand most often cited under product experience, system integrators rarely favor a single vendor’s products. Fewer than 8% of all survey respondents cited Allen-Bradley without also citing at least one of the four, next most-popular brands.

Areas served

So where do system integrators apply all of their skills and the products they implement? Geographically, system integrators seem to be evenly spread throughout the U.S. and overseas, with somewhat less of a focus on Canada. (See the “Areas Served” chart.)

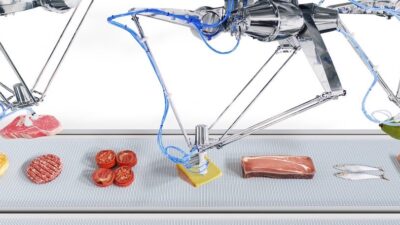

In terms of vertical markets, however, survey respondents did indicate a distinct preference. Over half of the participants claimed experience in the food and beverage industry, as opposed to just 42% for the second most popular industry, chemicals and petrochemicals. (See the “Industries served” chart.) “Other” continuous and batch processing industries came in 5that 39%. Third and fourth spots were accorded to two discrete industries—automotive and material handling, respectively.

Survey respondents cited every U.S. region as an area served, though 28% of those located in North America have offices in Ohio, Pennsylvania, California, or Texas.

In terms of industries served across all geographic areas, although two process industries topped the list of industries served by survey respondents, the top 20 selections were evenly split between discrete- and process-industries.

Integrator profile

One characteristic that does not seem to help with the definition of “system integrator” is company size. Although 58% of respondents reported less than $5 million in annual revenues, the remaining annual revenue figures spanned the financial spectrum from $5 million to well over $50 million. (See the “Annual revenues” chart.)

Size did tend to determine the scope of the services that one system integrator could provide. The larger respondents cited more areas and industries served, as well as engineering specialties and product experience than smaller companies in the survey. As might be expected, smaller companies tended to focus more energy on a narrower range of industries and engineering specialties.

Smaller respondents also cited fewer corporate affiliations—vendors for whom they are a distributor, value-added reseller, or authorized system integrator. (See the “Corporate affiliations” chart.) Integrators reporting annual incomes exceeding $5 million averaged 6.3 affiliates each, whereas those reporting annual incomes below $5 million averaged 4.8.

This would seem to indicate that the smaller system integrators prefer projects to which they can bring a product-independent point of view. For them, open systems and compatible products from multiple vendors are critical. Larger system integrators, on the other hand, can afford to work with the more complex, proprietary systems that require the vendor’s involvement.

Other integrator characteristics illustrated by the survey include:

Most survey respondents reported annual revenues less than $5 million, compared to $5.2 million for the average CSIA member in 2004.

The average system integrator firm is less than 22 years old, though some that are divisions of major automation vendors can claim to be well over 100.

Although 83% of all survey respondents claimed to be independent system integrators, 65% cited some sort of “affiliation” with at least one automation product vendor.

System integrators cite affiliation with the CSIA more than any other professional organization that takes entire companies as members. Integrator employees are most often individual members of the IEEE and ISA.

Consistency

It is also interesting to note that these survey results are similar to findings of an earlier study done for the 1995 edition of the Automation Integrator Guide ( Control Engineering , December 1994).

Then, the average automation system integrator was slightly under 20 years old, earned less than $5 million annually, and typically worked on process-, batch-, and supervisory-control projects. The tool of choice was the PLC, especially models by Allen-Bradley, GE Fanuc Automation, Modicon, and Square D (the latter two now are brands of Schneider Electric). Besides PLC installations, system integrators surveyed in 1994 were most adept at designing and implementing human-machine interface systems incorporating software from Intellution (now part of GE Fanuc) and Wonderware.

The 1994 results also showed the same discrepancy between preferred computing platforms and discrete vs. continuous process control applications. The PLC was cited as an engineering specialty half again as often as the DCS, even though the top three industries served were all process oriented—continuous and batch processing, food and beverage, and chemicals and petrochemicals. Only one traditionally discrete industry—material handling—made it into the top five most-cited industries served in 1994.

Similarities to the 2005 results are even more striking in light of the fact that the survey sample size more than doubled, from 623 to 1,418, and only 417 integrators participated in both studies. The increase in respondents just goes to show, by looking at these numbers, very little has changed in the automation system integration business over the last 11 years.

Simplify the search for a system integrator

Even for the end-user who knows exactly what kind of system integrator to use, finding the right one for a particular project can be a challenge. A recent Google search on the term “system integrator” turned up nearly 8 million hits, yet on the first 10 pages, only 10 entries were for industrial automation system integrators.

Fortunately, the first hit on the first page was a link to Control Engineering’s online Automation Integrator Guide, a searchable database of all 1,418 industrial automation system integrators surveyed for this article. With the Integrator Guide’s multi-criteria search engine, end-users may search for system integrators matching any combination of these criteria—industries served, areas served, engineering specialties, product experience, corporate affiliations, professional affiliations, and annual revenue.